Buying an Apartment to Rent on Airbnb on the French Riviera: Everything You Need to Know

The idea sounds dreamy, doesn’t it? Buy a charming apartment in Nice, Cannes, or Antibes, rent it out on Airbnb when you’re not there, and let it pay for itself (and maybe even generate a little income). The French Riviera is, after all, one of the most visited regions in Europe—and short-term rentals seem like a golden opportunity.

But as with many things in France, it’s not quite that simple.

Before you jump in, there’s a lot you need to know—about laws, taxes, building rules, and local politics. Short-term rentals have become a hot topic here, and in some cities, the rules are getting stricter by the year.

This guide will walk you through everything you should consider before buying a property to rent on Airbnb in the South of France—so you can make a smart, informed investment without unpleasant surprises.

1. First Things First: Is Short-Term Rental Allowed?

Not all properties can legally be rented on Airbnb, especially in tourist-heavy towns on the Côte d’Azur. Here’s a quick breakdown:

🏙️ In cities over 200,000 people (Nice, for example):

Short-term rentals are heavily regulated, especially if it’s not your primary residence. If you’re buying a second home or investment property, you may need:

- A change of use authorization (autorisation de changement d’usage) from the mairie.

→ How to submit a change of use application in Nice?

From 6 January 2025, you must submit your application online here https://www.changementdusage.fr/nice

If the online form is unavailable, paper forms can be sent to you by post if you request them by email (changement.usage@ville-nice.fr) or post (Mission Protection des Logements, 5 Rue Gabriel Fauré, 06000 Nice).

- Applications can be submitted in person by appointment only: 5 Rue Gabriel Fauré, Nice, 5th floor

- Appointments can only be made on the website: Make an appointment

- Submission by post is possible: Mission Protection des Logements 5 Rue Gabriel Fauré – 06000 NICE

2.To « compensate » the loss of housing—by converting an equivalent surface of commercial space into residential use. This is known as the compensation rule, and it can be extremely costly and complex.

→ What is compensation ?

Compensation consists of converting premises in NICE that were used for purposes other than residential purposes on 1 January 1970 or that were subject to planning permission changing their use after 1 January 1970 and that have not already been used as compensation.

Compensation may also be achieved by purchasing a compensation title (also known as a commerciality title) from a third party who owns premises used for purposes other than residential (offices, shops, etc.) that they intend to convert into housing. These rights may be purchased from specialised companies or social landlords.

The premises used as compensation must be located in Nice and meet the requirements of decency and the provisions of the co-ownership regulations, if applicable.

🏘️ In smaller towns (like Antibes or Menton):

The rules are often more relaxed, but this is changing. Many towns now require registration numbers for short-term rentals and may limit the number of days you can rent per year.

NB : Des petites communes comme Villeneuve-Loubet ou Villefranche-sur-Mer ont également voté en faveur de mesures restrictives face à Airbnb.

✅ Action Step:

Before you fall in love with a property, check with the mairie or a local property expert about the local short-term rental policy. It can vary drastically from one commune to another.

2. Primary Residence vs. Secondary Residence

In France, the law treats primary and secondary residences very differently when it comes to short-term rentals.

✅ If it’s your primary residence:

- You can rent it on Airbnb up to 120 days per year without special authorization.

- This includes renting a room while you’re living there, or the whole place while you’re away.

🚫 If it’s a secondary residence or investment property:

- In many areas, this triggers much stricter rules.

- You’ll likely need to register, and possibly obtain a change of use authorization.

- The 120-day limit does not apply, but the city may still cap your activity.

Proposals from the mayor of Nice to limit Airbnb rentals:

- Reduction in the duration of temporary authorisations: from 6 to 3 years, non-renewable.

- Limit the duration of tourist rentals of a primary residence to 90 days per year (initially 120 days).

- Require the production of a mandatory energy performance certificate (DPE).

- Sworn declaration of compliance with co-ownership regulations.

- Maintain the principle of compensation from the first property for legal entities and from the second property or at the end of the permit’s validity period for individuals.

- Promote mixed rental for student housing.

3. Building Rules: The Hidden Gatekeeper

Even if the city says « yes », your building syndicat (the co-ownership board) might say « no. »

In apartment buildings, co-owners can vote to ban or restrict Airbnb-style rentals in the building’s bylaws (règlement de copropriété). This is common in more residential buildings where neighbors want peace and quiet.

✅ Action Step:

Before signing anything, read the co-ownership rules carefully. Look for clauses that:

- Ban “meublé touristique” rentals.

- Limit professional activity in the building.

- Require prior approval for any form of rental.

And remember: even if short-term rentals are allowed today, the co-owners can vote to restrict them in the future.

4. The Tax Side: What You’ll Owe

Renting on Airbnb in France means you’re running a furnished rental business. That comes with taxes. Here’s what you need to know:

📄 Tax Regimes:

- Micro-BIC: If your revenue is under €77,700/year, you may qualify for this simplified regime. You get a 50% tax deduction, no need to declare expenses.

- Régime réel: For higher incomes or if you want to deduct actual costs (furnishing, maintenance, mortgage interest, etc.).

You’ll also need to:

- Register as a business (usually under the LMNP status: Loueur Meublé Non Professionnel).

- Pay social contributions if your rental income exceeds a certain threshold.

- Declare your income to the French tax authorities, even if you live abroad.

✅ Bonus Tip:

If you’re buying as a non-resident, talk to a French accountant. The tax setup can be optimized if done right from the beginning.

Would you like to know whether to buy a property to rent on Airbnb is a good idea?

5. Insurance: Are You Covered?

Standard home insurance doesn’t always cover short-term rentals. You’ll need to:

- Inform your insurer that you’re renting to tourists.

- Possibly take out a specific “meublé de tourisme” or Airbnb-compatible insurance policy.

- Make sure your guests are covered for damages, fire, etc.

Some insurance companies now offer policies tailor-made for Airbnb hosts in France.

No panic: FRH is here to help you to find the right insurance!

6. Maintenance, Check-Ins, and Cleaning

Unless you live nearby, managing a rental property from abroad can be challenging. You’ll need to set up:

- A reliable local cleaner.

- Someone to handle check-ins and emergencies.

- Regular maintenance (especially in older Riviera buildings, which are charming but prone to plumbing surprises).

Some agencies specialize in short-term rental management and can take care of everything for a percentage of your revenue (usually 20–30%).

✅ Pro tip:

A hands-off Airbnb rental can be profitable—but only if you have good local support. FRH can recommend one of its partners for managing your seasonal rental.

7. The Market Reality: Supply, Demand & Seasonality

The Riviera is a tourist magnet, yes—but it’s also a highly seasonal market. Here’s what you need to know:

- High season (June–September): High occupancy, high nightly rates.

- Low season (November–March): Much quieter. You may get few bookings or have to drop prices significantly.

- Events matter: Cannes Film Festival, Monaco Grand Prix, Nice Carnival—these are golden windows for Airbnb hosts.

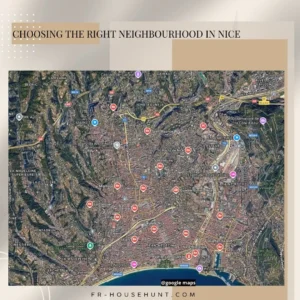

📊 Occupancy rates vary by town and even by neighborhood. A beachfront flat in Antibes will perform very differently than a 4th-floor walk-up in inland Nice.

8. Future Risks: Changing Laws & Local Sentiment

Across Europe, cities are tightening Airbnb rules to protect housing stock and reduce tourist pressure. France is no different. While Airbnb is still legal, there’s increasing pressure to:

- Limit the number of rental days.

- Ban short-term rentals in high-demand areas.

- Enforce heavier taxes and regulations.

What’s legal today may not be tomorrow. That doesn’t mean you shouldn’t invest—but you should be flexible in your expectations and prepared to pivot (e.g., rent long-term if the short-term model is restricted).

So… Is Buying an Airbnb Property on the Riviera Still Worth It?

Well, it depends.

✅ Yes, if:

- You do your homework.

- You buy in a city where Airbnb is still permitted.

- You get a property that can work as a long-term rental fallback.

- You treat it as a real business, not just a side hustle.

🚫 Probably not, if:

- You want completely passive income without any involvement.

- You assume you can rent freely anywhere.

- You’re buying emotionally without checking the rules.

With the right strategy—and the right guidance—it can still be a smart move. But it’s no longer the easy money it was in 2015.

Final Word: Local Expertise Is Key

If you’re not based in France, navigating all these layers—laws, taxes, building rules—can be overwhelming. That’s where working with a local property hunter can make all the difference.

A good chasseur immobilier will:

- Help you find properties with solid rental potential.

- Flag legal or co-ownership restrictions before you buy.

- Connect you with trusted accountants, managers, and cleaners.

- Give you a realistic view of the rental market, not just the dream.

Thinking of buying a rental property on the French Riviera?

Let’s talk. I help foreign buyers find smart, legal, and profitable investment properties—without the nasty surprises.

Contact us